Features

StoneCastle, a homegrown cannabis mutual fund

Published on August 6, 2021 by Corinne Doan

Cannabis legalization has opened investment opportunities. Media buzz mostly focuses on cannabis stocks; however, if you don’t have the time or comfort level to choose investments, there is another option.

A mutual fund is an investment vehicle made from a pool of money created by many investors. The fund invests in a variety of stocks, bonds, money market and other assets.

Mutual funds give an opportunity for smaller investors to access a variety of investments. For as little as $500 an investor can buy into a diversified portfolio that is professionally managed.

The key advantage of the fund is its manager. Mutual funds must be managed by professionally qualified portfolio managers. The manager is responsible for allocating the funds’ assets with the goal to make a profit. The manager investigates potential investments, employs a variety of technical financial tools to assess validity, and monitors markets to choose the best time to buy or sell.

There are various fees and charges for managing funds which impacts overall returns. More, there are several categories of funds to match investor’s risk tolerance levels and investment objectives.

It is important to note, the cannabis industry is emerging. Therefore, currently all cannabis investments whether they be a stock or mutual fund, are considered speculative high risk. Similar to a stock, mutual funds go up and down in value and it is possible to lose your investment. A mutual fund mitigates the risk of putting all the investment eggs in one basket so to speak, so it’s perhaps less risky than purchasing a solo stock.

Yet, so far in Canada there are few cannabis-focused mutual funds.

As a result of having Canada’s largest stock exchange, Toronto is considered the financial hub of the country. Typically, most funds are managed in Eastern Canada. It is remarkable to discover an asset management firm based in the West is one of the few companies in the country to be offering a cannabis fund. And so, let’s take a closer look at that firm and the man behind it.

Enter, cannabis investor Bruce Campbell

Working from his corporate office in Kelowna, Bruce Campbell is a familiar face on media platforms such as BNN and the weekly CSE Market Recap show. He aptly discusses insights for various market trends, including cannabis. Campbell spoke recently with the oz.

Photo: BNN

Campbell was born and raised in Grand Prairie, Alta. While growing up, he worked at the family pharmacy. His interest with stocks started during high school when he invested at discount firms using an antiquated phone system pushing many buttons. He relocated to Edmonton to attend the University of Alberta where he acquired a B.Comm degree. His first independent job was as a ski instructor during his university years. When he completed his degree in 1993 he relocated to the sunny Okanagan. That same year he jumped straight into a career as a stockbroker with Richardson Greenshields. As a new ambitious broker, Campbell also studied for and passed the onerous and difficult Portfolio Manager credentials. That gave him a unique ability to be a discretionary trader to manage his clients’ portfolios. Discretionary trading rights are highly regulated in the investment industry and a privilege enjoyed by few brokers, and usually reserved for someone who is a senior broker or a manager. He discovered it was something he excelled at, and he kept working on it. In 1999, he joined a firm that was acquired by Raymond James. Although well known in the US, Raymond James was new to Canada in 2000, when Campbell became only their fifth Portfolio Manager.

August 2008 held momentous tests for Campbell. It was the beginning of the market crash which went on to trigger a worldwide recession. Campbell parted ways with his good gig at Raymond James and launched his own firm, StoneCastle Investment Management Inc. If those challenges weren’t enough, at the end of August his wife gave birth to their first child. Campbell was a new dad starting a new business and he didn’t know if his clients would follow him, what staff he would have, or what was going to happen with the markets. It speaks to his skills and fortitude, he got through it.

Today, StoneCastle employs three, including Campbell. He is the portfolio manager for four mutual funds. And he has something north of $150 million in assets under his management, including the StoneCastle Cannabis Growth Fund.

Why cannabis investments?

In 2012-13 the Canadian government started changing cannabis regulations from a MMAR to a MMPR system which would eventually pave the way for today’s Licensed Producers. Campbell and his team took note the cannabis industry was a fairly significant illegal business and at some point would become a legal business. At that time, Health Canada had indicated it would limit the number of licenses to 20 operators. It seemed like an estimated $5 billion illegal market in Canada with 20 operators was a huge opportunity. During the same timeframe, the tide was turning in the US. Colorado was moving towards legalization. California was there medically. Campbell took a look and thought it was a gigantic industry worldwide. Just from a recreational standpoint, the wave moves from illegal to legal indicated there was going to be a huge opportunity. StoneCastle started cannabis investing in 2013. At first, they did it quietly because it was at a point when it was a small investment management company in Kelowna and didn’t want to be known as some sort of “pothead investors.” They started investing with Tweed which is Canopy Growth today. In 2014 they went on to invest in Origanigram, Bedrocan, and Aphria. Keeping things quiet, they did really well. Then one day Campbell was talking to a reporter from Bloomberg who would quite often call to ask what was moving and wasn’t. Campbell commented “cannabis stocks,” and the reporter quoted him.

The reporter’s article and Campbell’s comment were noticed. People reached out because they wanted to ask how to invest in cannabis stocks. This was around 2015-16 when things were becoming a little more mainstream. The full medical market was up and running. There was talk for a recreational market. And then the 2016 election happened. And more people asked for cannabis investments.

That’s when Campbell decided to get to work on launching a cannabis fund. His partner Redwood (which today is Purpose Funds), passed on the idea so another partner was found with Toronto-based Spartan Fund Management Inc. It took a year and a half from a regulatory standpoint to satisfy the requirements of multiple regulators but Campbell forged through the obstacles because he felt, “it would be probably one of the fastest growing sectors over the next decade. It was an opportunity to invest in an emerging and quite interesting industry.”

“This will (be) the fastest growing sector globally over the next decade and probably next two decades.”

The fund launched in September of 2018. Canada legalized cannabis in October. And then, as it turned out, cannabis stocks commenced a steady decline for the next year and a half, bottoming out during the onset of the pandemic in April of 2020. The history of StoneCastle fund’s value reflects that struggle. A $1,000 investment at the inception of the fund would have been worth $460 as of March 31, 2020.

When asked about the challenges for the first two years of the fund Campbell commented: “The sector itself has been very volatile but it always has been ever since we were involved. (There has been) probably six swings where you can see 50% up or down. The challenge is not managing volatility, it’s more managing people’s expectations of volatility… (It’s) not like a traditional sector where the cycle is 18 to 24 months long. It’s three months on the upside and three months on the downside…The biggest challenge is that people miss the opportunity, and I don’t know if they necessarily believe the long term… where I think from this point forward it will probably end up being one of the fastest growing sectors over the next decade outpacing a lot of the other sectors… the biggest challenge is showing people the opportunity and having them see the opportunity.”

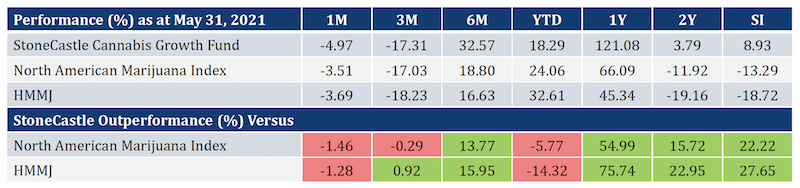

To Campbell’s credit, although cannabis stock prices were down, the fund still managed to outperform the North American Marijuana Index to which it is benchmarked. Strikingly and conversely, there has been a steady increase for cannabis stock prices during the past year. And the StoneCastle fund has capitalized successfully on the upward trend. “Although the North American Marijuana Index is 43.81% over the past 12 months, StoneCastle has outperformed the Index by over 22% with a 12-month cumulative return of 65.98%,” according to Spartan’s August 5, 2021 monthly update letter.

Today, things are heating up in the cannabis market. StoneCastle has a head start because it has built an extensive network which grants unique options for staying on top of deal flows. “Being around as long as we now (have) been, we are on most people’s radar list. When the cannabis market is hot, I’m not exaggerating, we get dozens of pitches a week. We sort of see a lot of variations. We don’t see everything, but we see a lot that’s out there. We know all the interesting management teams. We know all the analysts certainly in Canada and some in the US. We know a lot of the other asset managers who are in this space, so we see a fair bit of what’s out there.”

While busy in the present, Campbell has his eye on the future. When asked what story he would most like to tell he had this to say. “I mean probably the thing I think most passionately about in the cannabis industry is (the) fact that I think this is going to be even from this point forward and you can time stamp this, this will (be) the fastest growing sector globally over the next decade and probably next two decades. I think there is a huge opportunity for the black market to become the legal market obviously that’s not true growth if you can look it from that perspective but from a legal market standpoint it will be because you are basically starting from scratch turning these huge markets. And that’s the story I think is most exciting is the fact this will be a massive industry over the next decade or two as that wave of change goes through the world. We’ve obviously seen it in Canada we are seeing it in the US, we are starting to see it in Europe, we are starting to see it in Asia, and I just think like 10 years from now I’d be shocked if cannabis isn’t a portion of every institutional portfolio that’s out there—but it’s not today.”

Although there are many ways to measure success, when asked what his stick is, Campbell focused on his business. He said “I’m a competitive guy. The fund’s performance and where we rank is one of the biggest. Have a presence and impact people. We get lots of messages from people I have talked to or heard from BNN, so that’s good. From a firm standpoint, manage as much as we can and do the best job doing it.” Living in the Okanagan with his wife and two sons Campbell is active with hockey, skiing, and soccer. It’s stereotypical for most stockbrokers to have a golf handicap, but when asked what’s his, Campbell responded “Bad. I used to be decent but then I had kids, so I don’t golf much anymore.” And that perhaps, reflects his truer success.

StoneCastle Growth Cannabis Fund

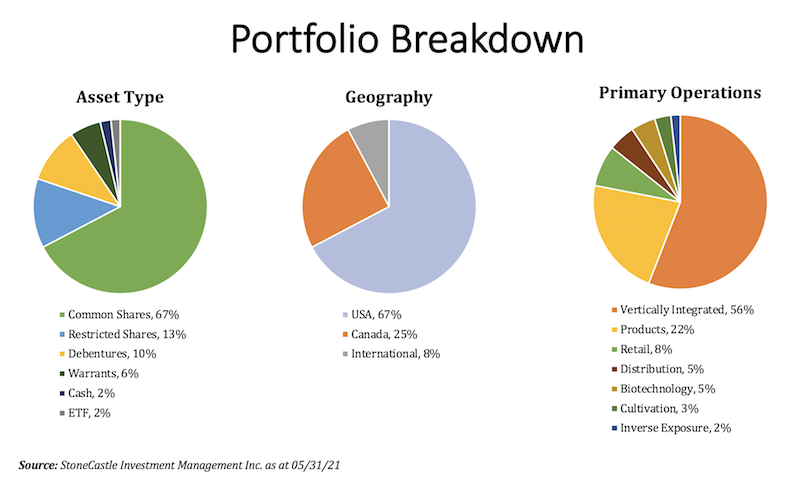

The Fund launched in September 2018 and “invests primarily in equity securities of North American publicly listed companies that operate in, or derive a meaningful portion of their revenue or earnings from, the cannabis industry or related industries, such as cannabis production and distribution, biopharmaceuticals and other ancillary businesses including edible and infused cannabis products, nutraceuticals, real estate, technology, security solutions, financing, delivery systems and retail distribution,” says its website.

StoneCastle Cannabis Growth Fund returns are net of management and performance fees for the ‘F’ series of units, but do not take into account early redemption fees if investments are held less than 1 year. Inception date is September 14, 2018. 2Y and SI returns are compound annualized returns. (Source: www.stockcharts.com, Solactive AG, StoneCastle Investment Management Inc.)

At the end of May 2021, the Fund’s annualized return was up 8.93% since its inception.

Although available for purchase at most broker-dealers, investors who are interested in allocating to the StoneCastle Cannabis Growth Fund through their discount broker may need to contact their broker directly if they do not see the Fund listed there.

About the author

Leave a comment on our Facebook page.

© Copyright 2021 Okanagan Z. | About the oz.

Report a Typo or Inaccuracy

We strive to avoid typos and inaccuracies. However, on occasion we make mistakes. We value your contributions and help in correcting them.