News

The Valens Company suffered significant loss in 2021

Published on March 4, 2022 by oz. staff

It was a rough year for The Valens Company financially.

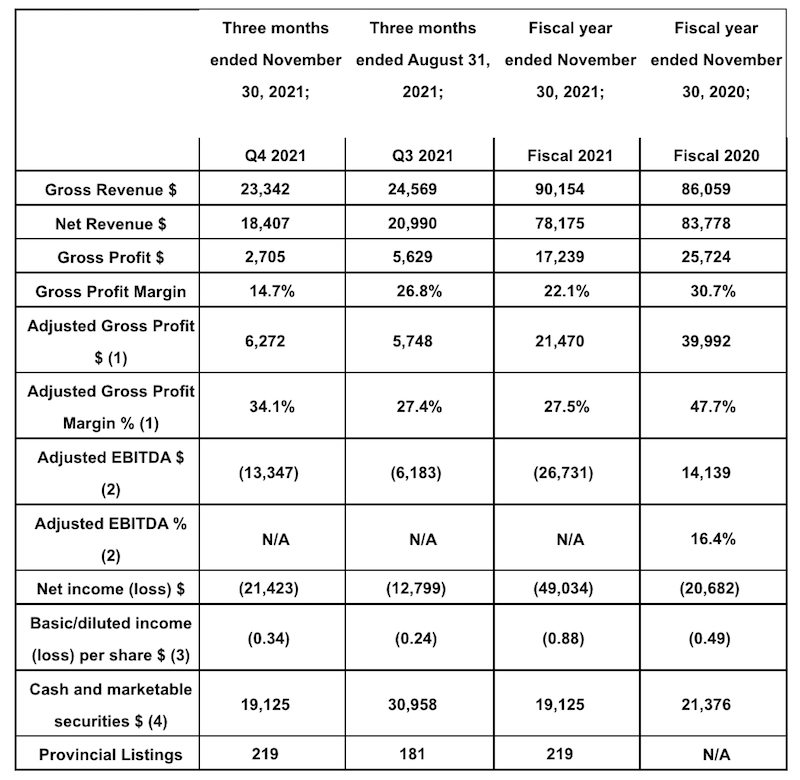

Valens suffered a nearly $50 million loss in fiscal 2021, according to their latest financial results.

The company also reported decreasing net revenue of $18.4 million in Q4 2021 and $78.2 million in fiscal year 2021, a drop of 12.3% compared to Q3 2021.

That downward trend was blamed primarily on a decline in B2B.

“I am very proud of our operations and logistics teams which have had to deal with a significant business transition over 2021 as well as automation delays, inflationary cost pressures, supply chain disruptions, and the flooding in British Columbia,” says CEO Tyler Robson.

“With further automation and our recently announced integration initiative, we are now heading down the path towards profitability.”

In 2021, the company acquired Citizen Stash, Green Roads and Verse Cannabis.

An analysis of Valens financials

By Corinne Doan

Valens reported its year end financials this week, for the year ending Nov. 30, 2021. Here’s what the numbers inform.

Profitability

Gross profit margin 24

Net profit margin (54.39)

Return on Assets (14.23)

Operating profit margin (128)

Analysis

Profitability assesses management’s ability to run the business. Although this writer’s calculations for gross profit margin differ slightly from Valens, both estimates suggest the business is profitable. However, the rest of the numbers indicate an operation deficiency that imply costs are higher than revenue.

Liquidity

Current ratio 20:1

Quick ratio 13:1

Working capital 35

Analysis

Generally, the higher the ratio values, the larger the safety margin the company has to cover short term debt obligations. Ideally, you don’t want to fall below 1. Valens liquidity appears to be in good shape.

Efficiency

Inventory Turnover ratio 1.35:1

Analysis

Although inventory turnover can change between industries, businesses, and product lines it is a good indicator that shows balance between production and sales. A ratio between 4 and 6 is usually a good indicator. Valens efficiency is less than optimum.

Financial Leverage

Debt ratio .25:1

Debt to equity ratio .3:1

Analysis

The debt ratio is below 1 which indicates the company has more assets than debt. The debt-to-equity ratio is well below the recommended 1.5 which shows strength. Valens has not overextended its leverage.

Shareholder return

Book value per share 4.68

Earnings per share (EPS) 1.41

Price to tangible book value (PTBV) 3.92

Analysis

Valens book value is above current market value. EPS indicates how much money is made for each share. Ideally it should be above 1 which it is at 1.41. Theoretically, tangible book value reflects the money an investor would receive per share if a company were to discontinue. With a PTBV at $3.92, Valens currently appears to be trading below its value.

- Calculations based on the closing market price of February 28, 2022, at $2.61/ share.

Concluding thoughts

As a former stockbroker, I raise a yellow flag and concerns regarding Valens’s diffused focus with a second Canadian production facility and headquarters in the financial hub of Toronto, Ont. The numbers indicate an operational deficiency and I question if that can be improved by closing the Ontario facility. Also, I do not believe this was an optimum time for a costly NASDAQ listing. The company is simply too young to take on such a venture. In my experience, both business decisions seem to appease an equity analyst point of view more than a stockbroker or common investor’s perspective.

More, I have a working theory that the best cannabis products originate in BC. And I believe BC’s best products comes from the Okanagan. Therefore, having operations based in the Okanagan has a built-in marketing advantage and opportunity. Valens core facility is based in Lake Country, BC, which is the heart of the Okanagan and would therefore be seemingly good. However, the Okanagan also has decades of legacy consumers who are extremely discriminate as to which products they will give credit or endorse. It’s not enough for a company to say its from the Okanagan and therefore is the best of BC. Respectfully, a company must win over the people of the Okanagan to get their endorsement to have the reputation of truly and authentically being the best. This is worthy to mention because it was noted Valens increased its marketing budget from $ 2,213,000 in 2020 to $ 10,813,000 in 2021. That’s almost a 500% increase. Also, noted on the most recent investor news release Valens has engaged an American public relations/investor relations firm based on New York’s famously expensive 5th avenue (KCSA Strategic Communications). To which I would like to ask, how much money has Valens invested on engagement, marketing, advertising, and feedback in the Okanagan this year? Because I live in the Okanagan, I have reason to believe the company has done very little to engage locally. Which speaks to the concern of divested interests and lack of focus on the core fundamentals.

Although the year end numbers show there is room for improvement with management operational efficiencies, their debt health indicates Valens can survive the short term. However, Valens secured a $40 million dollar loan after the year end financials were released which askew those numbers and calculations. With consideration to the overall market strength reflecting a worldwide pandemic, a current war, and ongoing federal illegalities in the USA, Valens is as steady as it can be in the storm.

Cori Doan is Canada’s first published author with a book regarding Canadian cannabis investments titled Canadian Cannabis Stocks Simplified: A How-To Guide for the Budding Investor. She was a licensed investment advisor with a focus on venture capital markets and held investment industry (IIROC) relevant licenses with the Canadian Securities Course (CSC), options and branch managers. Also, Cori has an MBA with specialty disciplines in public relations and communications. Any data or Information that is not directly cited in this report is believed to come from reliable sources. Calculations are on best efforts basis. Assessments are opinions only and are not a solicitation to buy or sell securities. Investors are encouraged to do their own due diligence.

Leave a comment on our Facebook page.

© Copyright 2022 Okanagan Z. | About the oz.

Report a Typo or Inaccuracy

We strive to avoid typos and inaccuracies. However, on occasion we make mistakes. We value your contributions and help in correcting them.