News

Canada is the world’s biggest cannabis exporter

Published on May 22, 2021 by David Wylie

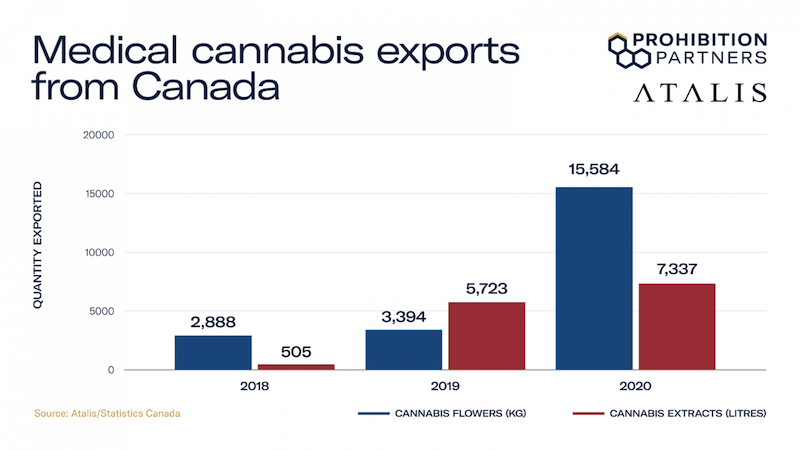

There has been a significant increase in Canadian cannabis exports in 2020, newly released data shows.

Info released by Statistics Canada to cannabis data company Atalis reveals in-depth details about cannabis being exported from Canada.

The data show that producers in Canada exported 15.6 tons of dried cannabis flower and at least 7.3 kilolitres of cannabis oils and extracts during 2020. That’s up from 3.4 tons of flower and 5.7 kilolitres of cannabis oils and extracts.

“This likely means that Canada is the single largest exporter of cannabis flower and oil in the world, ahead of the Netherlands, whose exports shrank slightly in 2020 compared to 2019,” says Prohibition Partners, which builds reports based on Atalis data.

What countries are buying Canadian cannabis?

Israel is currently the largest importer of medical cannabis flower from Canada, and Australia remains as the primary importer of medical cannabis oil. Following closely behind is the import market in Germany, the largest European medical cannabis market.

Germany imported over four tons of medical cannabis flower from Canada in 2020 and nearly five kilolitres of extracts and oil. Small amounts were sent to countries with new and growing industries such as the UK, Argentina and Malta, though how much is used by patients and how much in research is not known at this point.

The total customs value of medical cannabis exports in Canada in 2020 was $53 million, which is a considerable 229% increase compared to 2019. Most (83%) of this value originates from cannabis flower sales, though more oil sales likely occurred outside of these figures due to inconsistent reporting by exporters.

Canada is protectionist when it comes to cannabis

On the other side of the coin, virtually no cannabis was imported to Canada during 2020 according to Health Canada data.

“Canada’s policy on cannabis trade is a protectionist one, which seeks to incubate domestic businesses from the international market, while allowing for exports,” says Prohibition Partners.

“Medical cannabis exporters in the established markets of Canada and the Netherlands are facing competition from an increasingly long list of exporting nations such as Uruguay, Portugal, Spain, Denmark, Australia and Lesotho, among others. In addition, regions which have historically been importing medical cannabis such as Germany and Israel are currently building out domestic production capacities.”

“Producers seeking to import into Europe need to act strategically to be able to establish a niche in the growing markets, in terms of production costs, focusing on key product formats, navigating complex regional regulations and establishing a sales presence in relevant markets.”

Leave a comment on our Facebook page.

© Copyright 2021 Okanagan Z. | About the oz.

Report a Typo or Inaccuracy

We strive to avoid typos and inaccuracies. However, on occasion we make mistakes. We value your contributions and help in correcting them.