News

Tax is killing craft cannabis, says a new group

Published on September 30, 2021 by oz. staff

A new lobbying effort is pushing the federal government for tax reform.

The group, called Stand for Craft, says they are watching their peers go insolvent under the burden of excessive taxation.

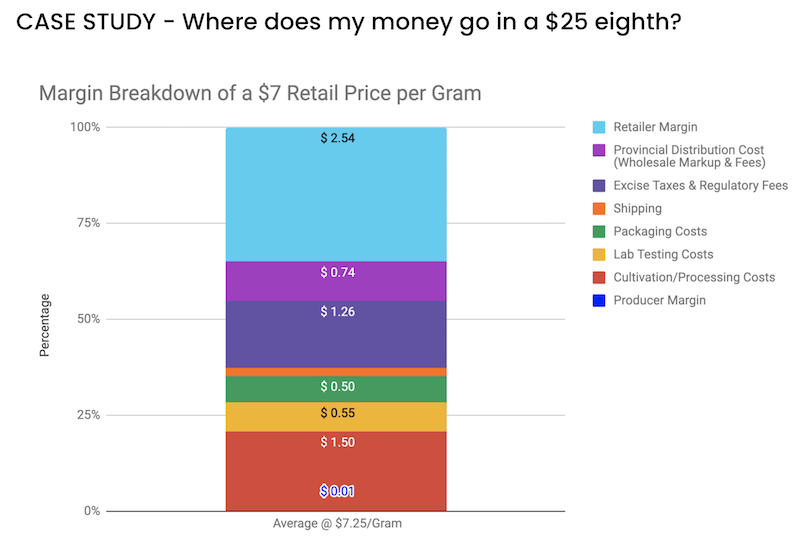

They say: “Canadian craft cannabis is being taxed to death,” with craft cultivators paying 20-30% of their top line revenues to excise tax.

The effort has been championed in the media this week by Tantalus Labs founder Dan Sutton.

He penned an op-ed published by Vancouver Is Awesome about it.

“Craft growers are facing extinction under the burden of an excessive taxation regime, and we are standing together to share this message with Canadians who believe in a diverse and equitable future for cannabis enterprises in this country,” he says.

A hill they will die on

No other product in Canada is taxed as heavily as cannabis, says the Stand for Craft website.

“This is often a higher monthly burden than their team’s salaries,” it says. “We need change now, and we need your voice to engage decision makers in government.”

“Immediate excise reform is a hill craft growers are literally about to die on.”

The group says large publicly traded LPs have the deep pockets needed to last while smaller businesses go under.

They are recommending two changes to excise tax policy in Canada:

- Remove the $1 minimum per gram tax per gram, and maintain a floating % on every gram sold.

- Tax businesses based on scale, similar to the Canadian beer industry

Call to action

Here’s a form letter you can send to your favourite decision-maker:

Dear cannabis industry stakeholder,

I am writing today in advocacy of substantial and short term cannabis excise tax reform. Small businesses in our industry are paying 20%-30%+ of their top line revenues to excise tax today, and this burden prevents their financial survival.

The current excise regime has inhibited basic business fundamentals such as EBITDA and cash flow even in the best craft market success stories. Craft producers cannot continue to operate under the burdens of the current taxation model.

Immediate excise reform is a hill craft cannabis businesses are literally about to die on.

Monthly excise burden often exceeds team salaries, and it materially inhibits legal craft growers from competing with both their illicit market and publicly funded counterparts. Price compression has pushed average cannabis prices below $4.5 per gram wholesale, driving the $1/g minimum to an unsustainable cost for small businesses.

It is no exaggeration to say Canada is taxing craft cannabis businesses to death.

I stand behind the value of a diverse Canadian cannabis market with participants of all sizes. Mom and pops shops, family businesses, independent teams, and small to medium enterprises all deserve their place in our industry.

This is the only model that delivers economic benefits equitably across the country, and small business inclusion is the example Canada must set for global cannabis legalization. All eyes are on our nation and our great legalization experiment, and our actions today will create negative or positive ripple effects for decades to come.

I personally recommend two changes to cannabis excise taxation in Canada:

- Remove the $1 minimum per gram tax per gram, and maintain a floating % on every gram sold for LPs of all sizes.

- Tax businesses based on scale, as we see in the Canadian beer industry. This compensates for the substantial economies of scale enjoyed by large producers. Introduce different tax tiers for:

Microcultivators

Craft Scale Standard Growers

Small to Medium Cultivation Enterprises

Large Cultivators

Thank you for the work that you do in service of a bright future for the Canadian cannabis industry. We hope that you will stand with us to evolve the industry forward.

Leave a comment on our Facebook page.

© Copyright 2021 Okanagan Z. | About the oz.

Report a Typo or Inaccuracy

We strive to avoid typos and inaccuracies. However, on occasion we make mistakes. We value your contributions and help in correcting them.